-

Full Capacity: Industry slings into Singapore as home stretch begins at SIRC

This week's newsletter discusses AUB's new investors, Hurricane Melissa's payout, AIG's acquisition of Everest's commercial retail portfolio rights, marine (re)insurers role in the stranded jets in Russia, Rokstone's interest in the Asian market.

-

-

Steadfast, Aviso, MSIG, UIB: 7 APAC insurance people moves of the week

Canopius, Sompo, GIC Re, FM and Peak Re also made personnel changes over the last week.

Steadfast, Aviso, MSIG, UIB: 7 APAC insurance people moves of the week

Canopius, Sompo, GIC Re, FM and Peak Re also made personnel changes over the last week.

Canopius, Sompo, GIC Re, FM and Peak Re also made personnel changes over the last week.

-

Peak Re tap Korean Re veteran Eun Jeong Lee as senior retrocession vice president

Lee relocates from Singapore to Hong Kong after spending over two years as deputy branch manager for Korean Re.

Peak Re tap Korean Re veteran Eun Jeong Lee as senior retrocession vice president

Lee relocates from Singapore to Hong Kong after spending over two years as deputy branch manager for Korean Re.

Lee relocates from Singapore to Hong Kong after spending over two years as deputy branch manager for Korean Re.

-

Steadfast calls for ‘shareholders’ patience’ amid Robert Kelly probe over employee complaint

CEO and managing director will remain on full pay for the duration of the 'external investigation' having 'chosen to stand aside' on a temporary basis on the eve of Friday's AGM.

Steadfast calls for ‘shareholders’ patience’ amid Robert Kelly probe over employee complaint

CEO and managing director will remain on full pay for the duration of the 'external investigation' having 'chosen to stand aside' on a temporary basis on the eve of Friday's AGM.

CEO and managing director will remain on full pay for the duration of the 'external investigation' having 'chosen to stand aside' on a temporary basis on the eve of Friday's AGM.

-

FM promotes Calvin Kuan to client service manager for Southeast Asia

Singapore-based Kuan will provide strategic leadership for FM’s underwriting and client service teams.

FM promotes Calvin Kuan to client service manager for Southeast Asia

Singapore-based Kuan will provide strategic leadership for FM’s underwriting and client service teams.

Singapore-based Kuan will provide strategic leadership for FM’s underwriting and client service teams.

-

Hong Kong’s Cyberport aids Otonomi’s US$5m Series A funding round

Oversubscribed round for the New York City-headquartered blockchain-enabled parametric insurance platform was also led Hivemind Capital, Rothschild & Co Asset Management, ATX Venture Partners, and Portline Capital.

Hong Kong’s Cyberport aids Otonomi’s US$5m Series A funding round

Oversubscribed round for the New York City-headquartered blockchain-enabled parametric insurance platform was also led Hivemind Capital, Rothschild & Co Asset Management, ATX Venture Partners, and Portline Capital.

Oversubscribed round for the New York City-headquartered blockchain-enabled parametric insurance platform was also led Hivemind Capital, Rothschild & Co Asset Management, ATX Venture Partners, and Portline Capital.

-

Discipline key for APAC reinsurers as premium growth normalises due to softening, economic uncertainty: S&P

Rating agency says reinsurers are likely to pursue cautious expansion strategies tailored to their risk appetite and market conditions.

Discipline key for APAC reinsurers as premium growth normalises due to softening, economic uncertainty: S&P

Rating agency says reinsurers are likely to pursue cautious expansion strategies tailored to their risk appetite and market conditions.

Rating agency says reinsurers are likely to pursue cautious expansion strategies tailored to their risk appetite and market conditions.

-

Steadfast CEO Robert Kelly temporarily ‘stands aside’ amid probe into workplace complaint

Tim Mathieson, CEO of Australasian broking, has been appointed as acting chief executive officer, effective immediately.

Steadfast CEO Robert Kelly temporarily ‘stands aside’ amid probe into workplace complaint

Tim Mathieson, CEO of Australasian broking, has been appointed as acting chief executive officer, effective immediately.

Tim Mathieson, CEO of Australasian broking, has been appointed as acting chief executive officer, effective immediately.

-

Sompo Asia Pacific appoints Leo Jun Liu as chief consumer officer for China

Liu, who joins from AIG, will lead Sompo China’s consumer lines strategy and operating model to drive scale, profitability and sustainable growth.

Sompo Asia Pacific appoints Leo Jun Liu as chief consumer officer for China

Liu, who joins from AIG, will lead Sompo China’s consumer lines strategy and operating model to drive scale, profitability and sustainable growth.

Liu, who joins from AIG, will lead Sompo China’s consumer lines strategy and operating model to drive scale, profitability and sustainable growth.

-

Southeast Queensland hailstorm claims top 10,000 as clean up continues

IAG and Suncorp are dealing with claims and significant costs after the event struck the Brisbane region on Sunday.

Southeast Queensland hailstorm claims top 10,000 as clean up continues

IAG and Suncorp are dealing with claims and significant costs after the event struck the Brisbane region on Sunday.

IAG and Suncorp are dealing with claims and significant costs after the event struck the Brisbane region on Sunday.

-

UIB Asia Reinsurance Brokers names Serene Chiam as treaty, retro director

She brings more than two decades of experience in the insurance and reinsurance sector.

UIB Asia Reinsurance Brokers names Serene Chiam as treaty, retro director

She brings more than two decades of experience in the insurance and reinsurance sector.

She brings more than two decades of experience in the insurance and reinsurance sector.

-

Rokstone sets sail for marine growth in Asia amid regional expansion

Two weeks into the operation, the marine specialty MGA in Singapore has already started binding policies, managing director Rama Chandran told InsuranceAsia News' Between the Lines podcast.

Rokstone sets sail for marine growth in Asia amid regional expansion

Two weeks into the operation, the marine specialty MGA in Singapore has already started binding policies, managing director Rama Chandran told InsuranceAsia News' Between the Lines podcast.

Two weeks into the operation, the marine specialty MGA in Singapore has already started binding policies, managing director Rama Chandran told InsuranceAsia News' Between the Lines podcast.

-

China empowers mainland insurers to issue sidecars in Hong Kong

NFRA notice on ILS seeks to enhance catastrophe risk management capabilities of Chinese insurers and strengthen Hong Kong's position as an international risk management hub.

China empowers mainland insurers to issue sidecars in Hong Kong

NFRA notice on ILS seeks to enhance catastrophe risk management capabilities of Chinese insurers and strengthen Hong Kong's position as an international risk management hub.

NFRA notice on ILS seeks to enhance catastrophe risk management capabilities of Chinese insurers and strengthen Hong Kong's position as an international risk management hub.

-

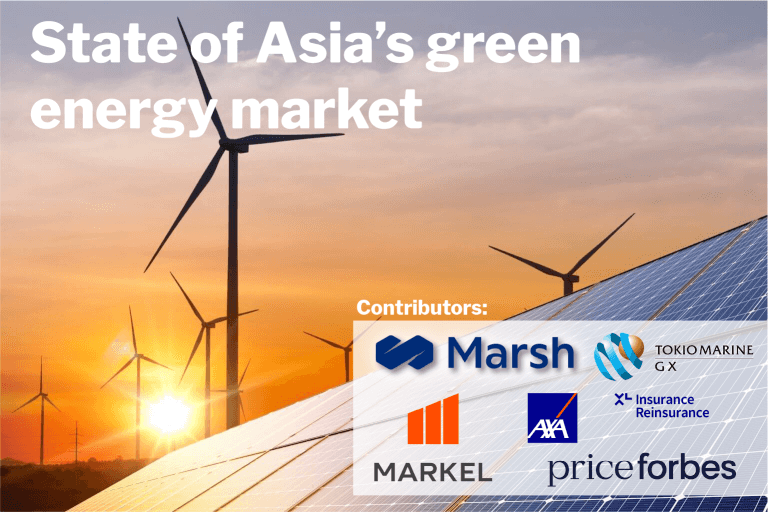

SOS: insurers fear Net-Zero Framework delay will send decarbonisation progress off course

International Maritime Organization's framework was approved in April and was expected to be formally adopted at a special meeting in London earlier this month.

-

Cargo insurers brace for distortion of established shipping patterns amid US-China trade war

Recent escalation following Chinese port fees could bring volatility, accumulation risks, political as well as contractual uncertainty and require commercial adjustments, underwriters say.

-

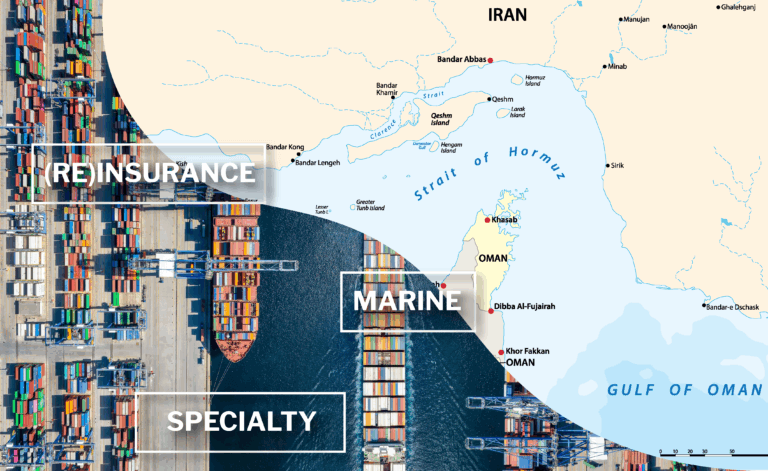

Russian stranded assets now viewed as US$10bn market loss

The bulk of the loss is also likely to be absorbed not by the aviation war market, as originally thought, but actually by the marine market.

-

Cyber insurers face ‘rising tide’ of criminal activity

Being prepared and having a playbook that's readily available is key in the face of increasing volume and sophistication of cyber attacks, risk managers say.

Between The Lines

A fortnightly podcast that unpacks the pivotal stories and trends shaping the (re)insurance industry across Asia Pacific.

Spotlight

-

Rokstone sets sail for marine growth in Asia amid regional expansion

-

Howden remains aggressive on Asia growth, with Japan, employee benefits as key priorities: Rohan Bhappu

-

Markel Greater China targets double-digit growth, doubles down on marine, AI risks

-

Japanese offshore wind a ‘big opportunity’ for (re)insurers: Tokio Marine

-

‘We have to roll with the punches’: testing time for evolving renewable energy market, Tokio Marine GX’s Will Hiller says

M&A

-

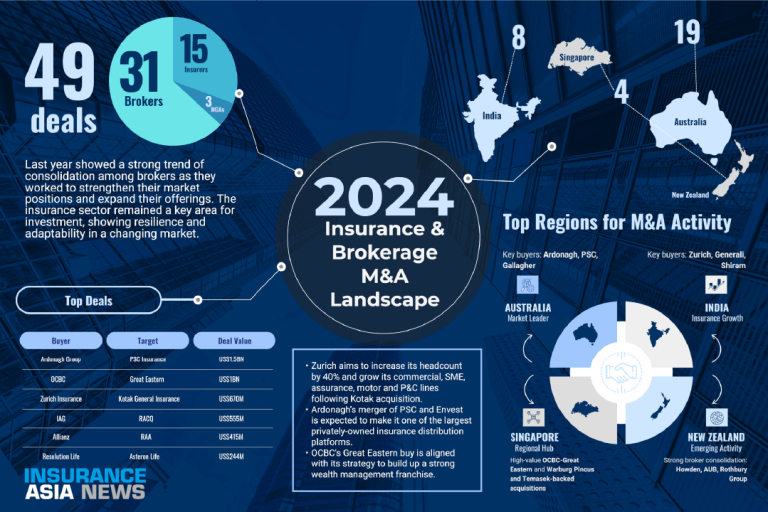

AUB Group confirms US$3.4bn takeover bid by EQT

-

AUB Group in trading halt amid reports of PE bid

-

Exclusive: Blackstone acquires majority stake in India’s Ace Insurance Brokers

-

Allianz in pole position to buy Nib Holdings’ travel business: report

-

IAG upgrades FY26 guidance following RACQ’s acquisition

ESG

-

Carbon credit specialist Oka launches in Singapore

-

‘You can’t do it as a hobby’: ESG must be a clear business model with easily measurable targets

-

Carbon specialist Kita expands into Australia

-

Maritime decarbonisation efforts need liability certainty to stay on course amid ‘pressing challenge’

-

With Donald Trump’s ESG curveball, what’s the outlook for APAC liability coverage?

-

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

Building resilience and mitigating risk in APAC's commercial property insurance market

Martin Au-Yeung, Vice President, Division Underwriting Manager at FM

Insurance broker market in Asia

Neelay Patel, Managing Director & Head of Growth, Asia at Aon

Nuclear: "The insurance sector is poised to play a central and enabling role in Asia’s nuclear expansion. As countries in the region move from exploration to active planning and construction – especially with a focus on SMRs – they will require innovative risk transfer solutions."

Clifford Blayney, Markel International